If you live in Japan or are doing business here, understanding Revenue Stamp is essential. These stamps are required for certain official documents, such as contracts and receipts, to pay the necessary stamp tax. Not using them correctly can lead to penalties. In this guide, you will learn everything you need to know about Revenue Stamp Japan, including how to buy them, when to use them, and how much tax you need to pay. Keep reading to make sure you stay compliant with Japan’s tax rules!

If you’re interested in more information about daily life in Japan, please check the article below.

Chapter 1: Introduction to Revenue Stamps

First, it is important to understand 印紙税 (inshi-zei, stamp tax) in Japan. This is a tax required for certain documents, such as contracts and receipts.

To pay this tax, a special stamp called 収入印紙 (shūnyū inshi, Revenue Stamp Japan) must be attached to the document. These stamps look like postage stamps but are used for tax payment instead of mailing. Once attached, they show that the required tax has been accounted for. However, the tax is only considered officially paid when the stamp is marked with a seal (hanko) or a signature to prevent reuse.

Chapter 2: Why Are They Important?

Revenue stamps (収入印紙) are required to pay stamp tax (印紙税). If they are not used when necessary, it is considered tax evasion.

The penalties for not paying the required tax vary depending on the situation. However, if the necessary revenue stamp is not affixed by the time the taxable document is created, a penalty tax may be imposed. This penalty is three times the original stamp tax amount—which includes the unpaid tax plus a fine that is twice the unpaid amount.

To avoid unnecessary fines, it is important to check whether a revenue stamp is needed before finalizing any official document.

Source: National Tax Agency

Chapter 3: Who Needs to Use Them?

Revenue stamps (収入印紙) are required for certain types of documents that involve financial transactions or legal agreements. The following are common taxable documents where a Revenue Stamp may be necessary:

- Real estate sales contracts (不動産売買契約書)

- Land lease agreements (土地賃貸借契約書)

- Advertising contracts (広告契約書)

- Loan agreements (金銭借用証書)

- Transportation contracts (運送契約書)

- Promissory notes and bills of exchange (約束手形、為替手形)

- Stock certificates, investment securities, and corporate bonds (株券、出資証券、社債券 など)

If you are involved in buying or leasing property, taking out a loan, or signing contracts for business, you may need to use a revenue stamp. Not attaching the correct stamp when required could result in penalties, so it is important to check in advance.

Source: National Tax Agency

Chapter 4: How Much Is the Stamp Tax?

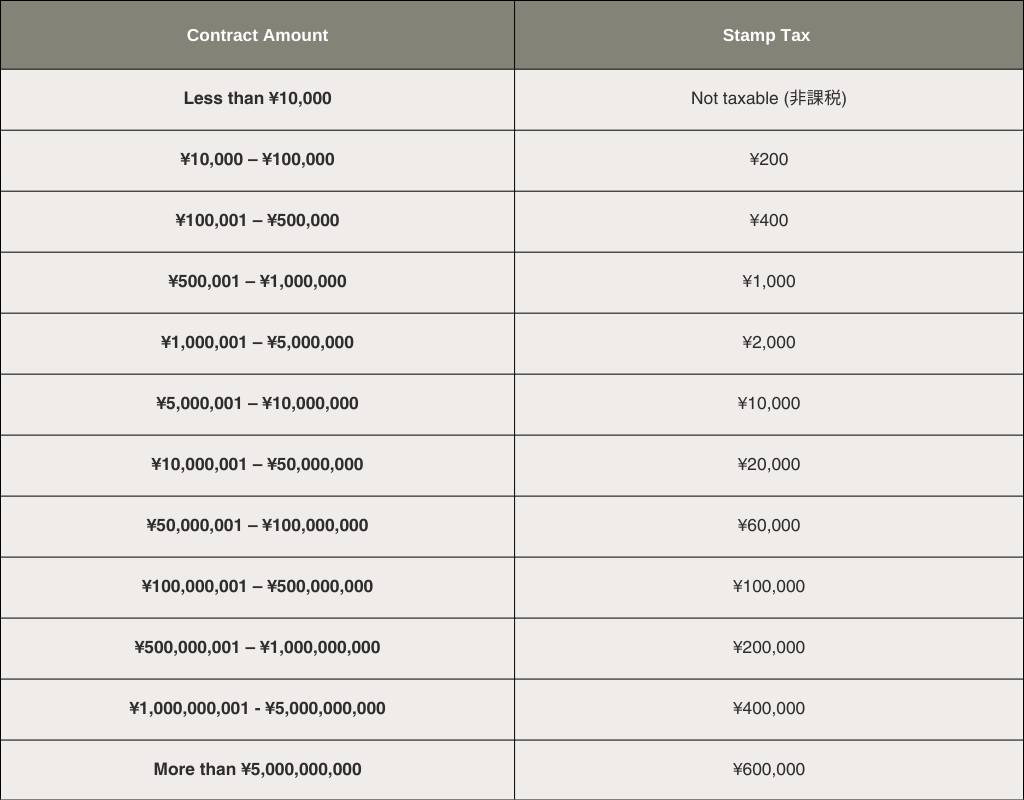

The stamp tax amount varies depending on the type of taxable document. The most commonly encountered cases, real estate sales contracts (不動産売買契約書) and land lease agreements (土地賃貸借契約書), have the following tax rates:

Source: National Tax Agency

Chapter 5: How to Purchase Revenue Stamps

Revenue stamps (収入印紙) can be purchased at various locations. You can buy them at post offices (郵便局) and legal affairs bureaus (法務局). In some cases, they are also available at convenience stores and liquor or tobacco shops.

If you see stickers that say “印紙” (stamp) or “郵便” (post) on the window, you can purchase revenue stamps there. However, convenience stores typically only carry smaller denominations, such as ¥200 worth of revenue stamps. For higher amounts, it is more convenient to visit a post office or legal affairs bureau.